Grid Reliability & Resilience in texas

Introduction

The reliability and resilience of Texas' electric grid have been under intense scrutiny in recent years, particularly in the wake of extreme weather events like Winter Storm Uri in February 2021. The Texas power grid, managed primarily by the Electric Reliability Council of Texas (ERCOT). Small areas of East Texas, the Panhandle, El Paso and Hudspeth Counties, the Cities of San Antonio and Austin and several small Municipal Utility Districts scattered throughout the state are not in ERCOT’s service territory.[1] ERCOT operates independently from the national grid, which creates both advantages and vulnerabilities. This issue paper examines the challenges and opportunities for improving grid reliability and resilience in Texas.

Current Challenges

1. Weather Extremes

Texas experiences a wide range of extreme weather conditions, from hurricanes and flooding to extreme heat and winter storms. These events strain the grid, as seen during Winter Storm Uri, when freezing temperatures led to widespread power outages affecting millions of residents.

2. Grid Isolation

ERCOT operates independently from the Eastern and Western interconnections to the National Grid, limiting its ability to import power during emergencies. While this independence allows for less federal oversight and more localized control, it also means that Texas has very limited ability to draw power from neighboring states in times of crisis.

3. Energy Source Mix and Capacity Constraints

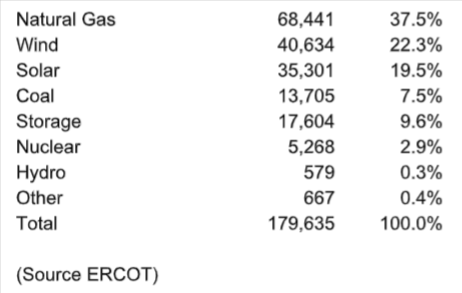

Texas relies on a diverse energy mix, including natural gas, wind, coal, solar, and nuclear power. However, natural gas infrastructure failures during Winter Storm Uri contributed significantly to power shortages. Renewable energy sources, while growing in capacity, face intermittency challenges without sufficient storage solutions.

Monthly Nameplate Capacity by Fuel Source (MW) – January 2026

Note: Actual generation mix can vary significantly over time depending on weather, time of day and grid conditions

Notably, Texas led the nation in wind-powered electricity generation, accounting for 28% of all U.S. wind-sourced electricity in 2023. (Source: EIA.gov)

ERCOT reported that net power generation increased from 429 terawatt-hours (TWh) in 2022 to 444 TWh in 2023. This growth was primarily driven by increases in wind and solar output, with utility-scale solar generation rising to 32 TWh in 2023 from zero in 2015. (Source: dallasfed.gov)

A new renewable generation record of 37,806 MW was set April 4, 2024, at 4:07 P.M Renewable penetration at record generation time was 69.47%.

4. Market Structure and Incentives

ERCOT operates under an energy (price)-only market structure, meaning power providers are compensated based on the electricity they generate rather than capacity availability. This model discourages investment in backup power and weatherization efforts, which are critical for resilience. ERCOT is the only deregulated electricity market in the U.S. with a price only market structure. The fundamental flaw of a price-only market design is there is no requirement to maintain or add capacity; hence no one has an obligation to serve.

5. Aging Infrastructure

Many components of the Texas power grid are aging, leading to inefficiencies and vulnerabilities. Transmission lines, substations, and power plants require upgrades to handle increased demand and extreme weather conditions.

6. Transmission Congestion

Congestion on ERCOT power lines has long been a problem on the Texas grid. It happens when lines don’t have the capacity to move all the energy that is being produced in one place, to the place where it is needed. As demand increases, congestion is more pronounced and frequent. Congestion puts the transmission lines at risk of being overloaded, and power needs to be curtailed to not damage the lines. Significant congestion currently exists from wind-rich West Texas to the east and wind-rich South Texas to the north.

Strategies for Improvement

1. Weatherization and Infrastructure Hardening

Mandating and incentivizing weatherization efforts for power plants, natural gas facilities, and transmission lines is critical. This includes insulation, heating elements for critical infrastructure, and reinforcing power lines to withstand severe conditions.

2. Energy Storage Expansion

Investing in battery storage and other energy storage technologies can mitigate renewable energy intermittency issues and provide backup power during peak demand periods.

3. Increased Interconnection with Neighboring Grids

While full integration with the national grid may not be feasible, increasing limited interconnections with neighboring states could provide emergency backup power without compromising ERCOT’s autonomy.

4. Market Reforms

Adjusting the ERCOT market structure to incorporate capacity payments or incentives for reserve generation could encourage power plants to maintain additional capacity for emergencies. In the last session the legislature provided the opportunity for low-cost state financing of new natural gas fired generation. This program has not been successful thus far.

5. Decentralized and Distributed Energy Resources (DERs)

Encouraging the adoption of microgrids, rooftop solar, and localized energy storage systems can reduce dependence on centralized power generation and enhance resilience during outages.

6. Demand Response Programs

Expanding demand response initiatives, which incentivize consumers to reduce power usage during peak demand times, can alleviate stress on the grid and prevent blackouts.

7. Incentives for Better Residential Insulation and Heat Pumps.

Texas has millions of poorly insulated homes with resistance (electricity) heating, which is very inefficient. When temperatures fall into the teens and lower, demand increases exponentially. This makes the grid much more vulnerable to extreme winter cold vs. summer heat.

Important Bills Currently Before the Texas Legislature

1. Senate Bill 819 (SB 819)

SB 819 is an updated version of SB 624 which failed to pass in the 2023 session. Introduced on January 16, 2025, this bill proposes new permitting requirements for wind and solar energy projects. If enacted, renewable energy facilities with a capacity of ten megawatts or more would need to obtain a permit from the Public Utility Commission of Texas (PUC) before interconnecting to transmission facilities. The application process would involve providing detailed information, including an environmental impact review conducted by the Parks and Wildlife Department. Existing facilities interconnected before September 1, 2025, would also be subject to these requirements if they increase their electricity output by five megawatts or more or make material changes to their placement. SB 819 would require the PUC to provide public notice of applications for new wind or solar facilities to county judges within twenty-five miles of the new facility, hold public hearings, and publish in two consecutive publications in a newspaper in each county in which the facility will be or is located. These requirements would not apply to other forms of generation.

This bill is not about the need for new permitting requirements. The intent of this bill is to kneecap deployment of additional renewable energy in Texas to enhance the competitiveness of natural gas fueled generating plants. The Forward Party of Texas opposes this bill. Texas needs more dispatchable generation, but this is not the way to do it.

2. Senate Bill 714 (SB 714)

SB 714 mandates that ERCOT and the PUC develop rules to address potential distortions in electricity prices caused by federal tax credits for renewable energy. The aim is to eliminate or compensate for any price distortions in the ERCOT market resulting from these federal incentives.

Price distortion means lower prices for renewable energy due to federal subsidies. The bill contemplates fees or surcharges on renewable energy to levelized the cost of renewable energy with cost of power necessary to maintain sufficient capacity to serve load at peak summer demand.

The bill also requires elimination of any rules, operating procedures or protocols that attempt to adjust electricity prices to reflect the value of reserves at different reserve levels.

This is very bad legislation. The intent of this bill is to raise the cost of renewable energy, perhaps to the point that fewer new renewable energy facilities are forthcoming. It is not in the best interest of Texas electricity consumers to undo at the state level, subsidies provided at the federal level. Additionally, it is not in the best interest of Texas electricity consumers to preemptively restrict ERCOT and PUC’s options for market reform (No 4 Market Reforms above) before they can be developed and reviewed for consideration.

The Forward Party of Texas opposes this bill.

3. Senate Bill 388 (SB 388)

This bill requires fifty percent of the megawatts installed in ERCOT after January 1, 2026, to be sourced from dispatchable generations (natural gas fired). S.B. 388 is another bill intended to kneecap deployment of renewable energy to benefit the oil and gas industry.

The legislation cannot guarantee outcomes but can result in unintended consequences. This bill needlessly meddles in energy markets. Such heavy-handed, anti-market legislation requires one megawatt of natural gas generation for every one megawatt of wind, solar and storage that gets built, constraining the ability to add economically viable and badly needed renewable capacity.

The market fundamentals necessary to provide for the outcome of this bill’s requirements are at high risk since the supply chain for natural gas turbines is constrained through 2030 [2], meaning no additional natural gas generating plants can be placed in service before 2031 [3].

In the absence of the installation of 50% renewable energy the bill calls for the PUC to develop a yet to be defined a “dispatchable generation credits trading program”. This program has two possible outcomes, higher prices in the form of credits purchased and/or less generation capacity (renewable) installed. Both outcomes will harm Texas consumers. Whatever one feels about clean energy vs. fossil fuels we should all agree that to be able to meet the huge increases in future demand due to population growth and new data center deployment (AI), Texas should encourage building all the renewable energy and storage it can as a bridge to replenishment of the gas turbine supply chain.

The Forward Party opposes this bill.

Written by the Forward Energy Committee, 2025